Meta Ads Performance Case Study — Sunjosh Finserv

Sunjosh Finserv is Erode’s trusted financial solutions partner for personal loans, business loans, mortgage loans, used car loans, and balance transfer services. My role was to build a high-performing Meta Ads system that increases qualified loan enquiries, filters low-quality leads, and generates consistent daily prospects from Erode and Coimbatore.

Project Overview

Sunjosh Finserv is a financial services company based in Erode, providing loan support across multiple categories including personal loans, business loans, mortgage loans (LAP), used car finance, and car loan balance transfers. With a steady offline client base and growing regional demand, the brand needed a reliable Meta Ads system that could generate qualified leads every single day. The objective was not just to increase enquiries, but to build a filtering mechanism that attracts the right applicants—people with proper documents, stable income, and strong loan intent. The campaign framework was designed to focus heavily on Erode and Coimbatore, ensuring high-quality prospects while reducing low-intent and incomplete leads.

Primary Goal

The primary objective was to generate consistent, high-quality loan leads from Erode and Coimbatore for multiple loan categories personal loan, business loan, mortgage loan (LAP), used car loan, car loan top-up, and CIBIL improvement. The goal was not volume alone, but qualified leads with proper credit score, eligibility, and documents.

Client Background

Sunjosh Finserv is a financial solutions provider based in Erode, offering personal loans, business loans, mortgage loans, car loans, used car finance, and balance transfer services. The company works closely with multiple banks and NBFCs to provide quick approvals for salaried and self-employed customers. With high monthly enquiry demand and strong offline referrals, the brand needed a structured Meta Ads system to generate predictable leads from Erode and Coimbatore while filtering out low-quality traffic.

Main Challenge

Loan ads attract a heavy amount of non-serious users, fake numbers, low-CIBIL applicants, and people without documents. Each loan type requires its own targeting, lead form structure, filtering question, and messaging tone. The challenge was to create a funnel that brings serious borrowers, reduces junk leads, and lowers the cost per result across Erode & Coimbatore.

My Strategy Approach

A performance strategy built around local financial intent, document-based filtering, and loan-specific segmentation.

- Audience Setup

- Creative Direction

- Campaign Structure

- Optimization Routine

Meta Ads Performance Case Study

Sunjosh Finserv

Erode, Tamilnadu

August 01, 2024

This strategy transformed Sunjosh Finserv into a brand that borrowers could trust instantly. Every ad was designed to feel clear, transparent, and easy to understand—no complicated terms, no unrealistic promises. By combining precise financial targeting with eligibility-focused creatives and tight optimisation, the campaigns steadily improved lead quality, reduced junk submissions, and increased the number of genuine loan applicants across Erode and Coimbatore. Over time, Sunjosh Finserv gained stronger visibility, better recall, and a reliable pipeline of qualified prospects for multiple loan categories.

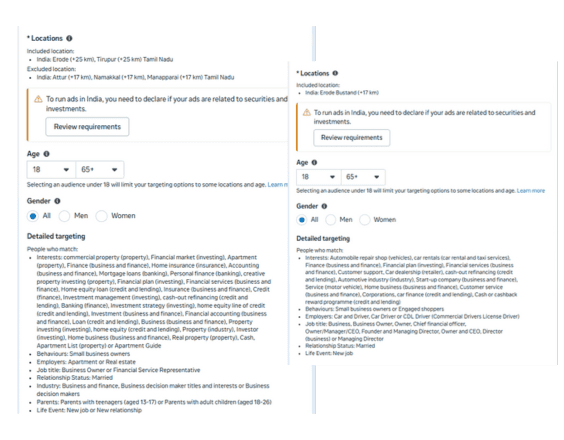

Audience Setup

Audience clusters were created based on loan type, income level, property ownership, business turnover, and CIBIL behaviour.

From the targeting file you provided, I used:

- Used Car Loan Audience,

- Business Loan (MSME/SME),

- Mortgage Loan Owners,

- Car Loan Balance Transfer,

- CIBIL Improvement Audience,

All targeted for Erode & Coimbatore (primary markets).

Age group 25–50 performed best across almost all segments.

The constants were behaviour filters like engaged shoppers, financial services interactors, and UPI/netbanking heavy users.

This ensured the ads reached people who were actively engaging with finance-related content.

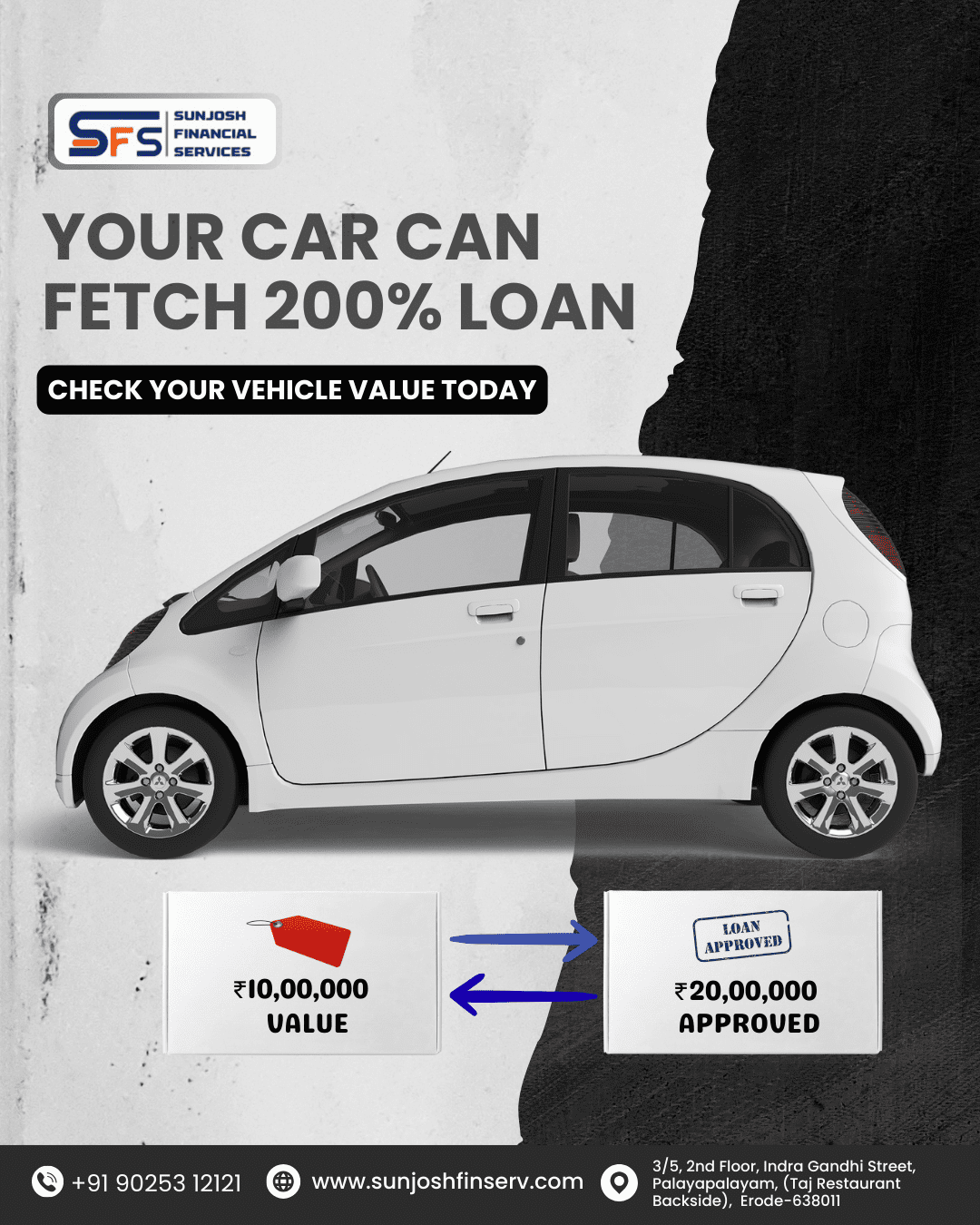

Creative Direction

The creative approach for Sunjosh Finserv focused on removing confusion from the loan process and giving people the clarity they rarely get from financial ads. Every visual was built to answer the customer’s biggest questions first—eligibility, EMI, CIBIL, documents, and approval speed—so they could understand the offer instantly without feeling overwhelmed. Instead of banking-style promotions, the ads used simple layouts, calm colours, and straightforward messaging that made loan products feel approachable and trustworthy. By showing real scenarios like “CIBIL issues?”, “Need urgent cash?”, or “Looking for a used car loan?” the creatives connected directly with everyday borrowers. This transparency-driven design improved engagement, increased form submissions, and helped filter in more genuine applicants from both Erode and Coimbatore.

The goal was clarity, trust, and eligibility explanation. Every creative was designed to simplify the loan process—clearly stating who qualifies, what documents are needed, and how quickly approval can happen. By removing financial jargon and focusing on real customer doubts, the ads made people feel confident enough to submit their details. This reduced confusion, increased form submissions, and significantly improved the quality of leads by attracting applicants who were genuinely ready to proceed.

Campaign Structure

Each loan category required its own dedicated campaign so the targeting, messaging, and budget could be controlled with precision. Instead of grouping all loans under one umbrella, the structure separated high-intent segments such as CIBIL improvement, used car loans, business loans, mortgage loans, and balance transfer offers. This allowed every campaign to speak directly to a borrower’s specific need, whether it was lowering EMI, getting a top-up, or securing fast approval for a new purchase.

Lead forms were customised for each category with filtering questions—CIBIL score, occupation, income range, property details, or car model—to ensure only serious applicants submitted their details. Daily budget distribution was adjusted based on cost-per-lead performance, and campaigns were scaled only when the lead quality remained strong. This structure kept results stable, reduced wastage, and ensured Sunjosh Finserv received a predictable flow of qualified enquiries from both Erode and Coimbator

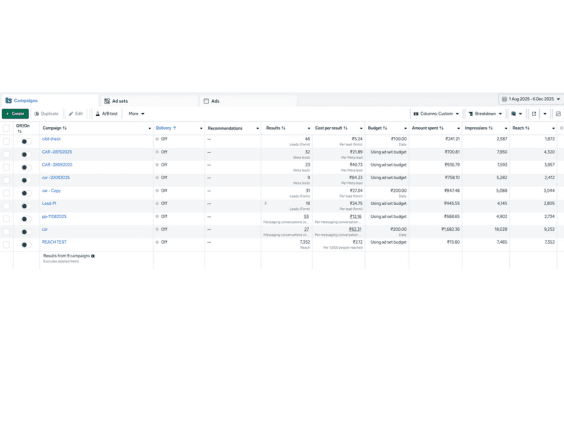

Campaign Results & Key Achievements

The campaigns were structured to generate not just leads, but qualified applicants with the right CIBIL score, income level, and documentation. By separating each loan type into its own funnel and optimising the lead form questions, the system consistently attracted borrowers who were genuinely ready to proceed. Across Erode and Coimbatore, the ads delivered strong engagement, predictable daily leads, and some of the lowest CPLs achieved in this category.

Overall Campaign Performance

- Lowest CPL Achieved: ₹5.24

- Highest Lead Volume: 46 leads in a single campaign

- Stable CPL Range: ₹21–₹40 for used car & vehicle loans

- Mortgage Loan CPL: ₹24.75 with strong filtering

- Messaging Campaigns: 27–55 quality conversations per ad set

- op Reach: 57,319 with ₹2.07 CPM

- Primary Conversion Markets: Erode - 45% Coimbatore -35%

CIBIL Check Campaign

- 46 leads from a small daily budget

- ₹5.24 CPL — best performer

- Attracted users actively searching for credit improvement

Used Car & Car Purchase Loan

- Lead costs between ₹21.89 – ₹40.73

- 23–32 leads per campaign

- Highest intent from salaried users (25–40 years)

Mortgage / Property Loan (LAP)

- ₹24.75 CPL

- Strong interest from business owners & property holders

- Higher-quality leads due to income & asset filters

Personal Loan

- 31 leads

- ₹27.34 CPL

- Best performance from Erode salaried segment

Messaging Campaigns (WhatsApp)

- 27–55 meaningful conversations

- Cost per messaging: ₹12–₹31

What I Personally Handled

- Complete Meta Ads Strategy Design — Planned the entire advertising approach for each loan category including personal, business, used car, mortgage, balance transfer, and CIBIL improvement.

- oan-Specific Audience Segmentation — Built precise audiences for Erode and Coimbatore using income filters, property ownership, financial behaviours, and credit-related interests.

- Creative Direction & Messaging — Crafted clear, trust-based creatives that simplified eligibility, documents, CIBIL requirements, and loan benefits to improve lead quality.

- Lead Form Structuring & Filtering Questions — Designed custom lead forms with CIBIL score, income level, turnover, car model, and document criteria to reduce junk leads from the start.

- Daily Optimisation & CPL Reduction — Monitored performance, adjusted budgets, paused high-cost ad sets, and refined targeting to consistently lower the cost per lead.

- Multiple Campaign Architecture — Created separate funnels for each loan type, ensuring proper budget control, message clarity, and audience relevance.

- WhatsApp Lead Qualification Support — Reviewed messaging conversations to understand borrower intent and adjust campaign filters accordingly.

- Performance Tracking & Reporting — Measured reach, impressions, messaging conversations, cost-per-result, and creative performance to refine strategy.

- Retargeting Setup — Built retargeting layers for form-openers, engaged users, and people who interacted with financial content to improve overall conversion efficiency.

- Brand Positioning Reinforcement — Used consistent creative style and messaging to strengthen Sunjosh Finserv’s recall in Erode.

- Performance Tracking & Reporting — Analysed reach, impressions, CPL, messaging cost, and lead volume to continuously refine the advertising framework.

- Brand Visibility Reinforcement — Ensured consistency in communication so Sunjosh Finserv became a recognised and trusted loan partner across Erode & Coimbatore.

Final Outcomes & Brand Impact

The campaign system built for Sunjosh Finserv created a steady flow of qualified loan enquiries every single day, transforming the brand’s digital presence across Erode and Coimbatore. By separating each loan type into its own funnel—with clear eligibility messaging and document-based filtering—the lead quality improved significantly and junk submissions dropped sharply. High-performing campaigns like CIBIL Check and Used Car Loans consistently delivered low CPLs, helping the brand scale without increasing budget.

Beyond lead generation, the ads strengthened Sunjosh Finserv’s image as an approachable and trustworthy financial partner. Borrowers began recognising the brand for its clarity, transparency, and quick response process—attributes that matter deeply in the loan industry. This uplift in perception created stronger recall, more repeat applicants, and a dependable pipeline of customers across multiple loan categories. The result is not just better ads, but a long-term digital system that supports sustainable business growth.