Sunjosh Finserv — Social Media Strategy & Lead Generation

Sunjosh Finserv helps individuals and business owners access fast, transparent, and reliable financial solutions including business loans, LAP, used car loans, and balance transfers. My objective was to craft a digital identity that builds trust, removes confusion, and drives high-intent loan enquiries through clear communication.

Project Overview

Sunjosh Finserv needed a digital presence that communicated trust, clarity, and simplicity—three elements critical in the finance industry where customers often feel confused about eligibility, documentation, interest rates, and approval timelines. Many loan seekers hesitate not because they don’t qualify, but because they don’t fully understand the process.

My role was to build a social media identity that removes this confusion, explains financial products in simple language, and positions Sunjosh Finserv as a reliable partner for business loans, mortgage loans, used car finance, and balance transfer solutions. This included complete strategy development, content planning, educational posts, WhatsApp communication, and lead-focused promotional creatives.

My Strategy Approach

I built a strategy focused on removing financial confusion, building trust, and guiding customers step-by-step through loan decisions. The approach centered on simplifying loan terms, explaining eligibility in plain language, and creating content that felt supportive rather than sales-driven. Every post was designed to reduce hesitation, increase clarity, and push high-intent users towards enquiry.

- Trust-building communication

- Zero-confusion financial language

- Real customer scenarios

- Eligibility & document explainers

- CIBIL awareness posts

- WhatsApp-based follow-up system

- Local-tone messaging for relatability

- Lead-conversion focused creatives

Social Media Strategy & Execution

Sunjosh Finserv

Erode, Tamilnadu

July 01, 2024

This approach helped Sunjosh Finserv appear transparent, reliable, and customer-first—three qualities necessary for loan-based decision-making.

Instagram Creative Posts-Content Created

For Sunjosh Finserv, I designed Instagram creatives that simplified complex financial topics and made loan information easy to understand for everyday customers. The posts covered eligibility, CIBIL score guidance, EMI clarity, and document requirements for various loan categories—helping users feel more confident about enquiring. Each creative followed a clean structure that guided customers from confusion to clarity within seconds.

- Business loan explainers

- Mortgage/LAP awareness posts

- Used car loan educational creatives

- Balance transfer + Top-Up breakdown posts

- EMI & interest-rate clarity content

- Document & eligibility checklists

- High-trust reassurance messages

- Offer-based loan promotions

- WhatsApp CTA-integrated posts

This format helped turn awareness into confident enquiries.

Each creative was structured with a very clear purpose. Every design followed a clean, minimal layout so customers could understand loan information quickly without feeling intimidated or confused. The communication was kept simple and direct, allowing even first-time borrowers to grasp eligibility, documents, and loan benefits within seconds. I adapted the tone to match how ordinary people think about finance—removing jargon, eliminating fear, and presenting complex terms in easy, relatable language.Every post was crafted for quick clarity — within a moment or two, users could understand what the loan was about, whether they qualified, and what action they needed to take. This approach made Sunjosh Finserv look consistent, trustworthy, and professionally reliable across all platforms. More importantly, it positioned the brand as a supportive financial partner rather than a typical loan seller, giving users the confidence that they were dealing with a clear, transparent, and approachable finance company.

WhatsApp Post Designs

I created dedicated WhatsApp post designs tailored for quick reading and immediate understanding — especially important in the finance category where customers often feel confused or unsure. The layouts were minimal, clean, and focused on simplifying loan terms, eligibility steps, and offer alerts into short, high-impact messages.

These WhatsApp creatives helped Sunjosh Finserv appear every day in the customer’s routine, building trust, awareness, and repeated recall — without using Meta’s costly broadcast feature. By posting daily WhatsApp Status updates, repurposing Instagram story creatives, and sharing key promotions in local community groups, the brand stayed visible and approachable for anyone looking for financial support.

- 4-line clarity messages

- Urgency-based posts

- Loan offer alerts

- Quick EMI explanation posts

- Benefit-driven headlines

- Local-tone conversational messages

- Status-friendly layouts

- Simple guidance posts

- Trust-building creatives

Each design was intentionally compact and easy to grasp within one second, ensuring customers immediately understood the message — whether it was about personal loans, business loans, top-ups, balance transfers, or eligibility criteria.This approach made Sunjosh Finserv stand out as a clear, trustworthy, and customer-first financial partner, especially in a category where most people struggle with complex terms and confusing loan information.

Commercial Ad Creatives — Content

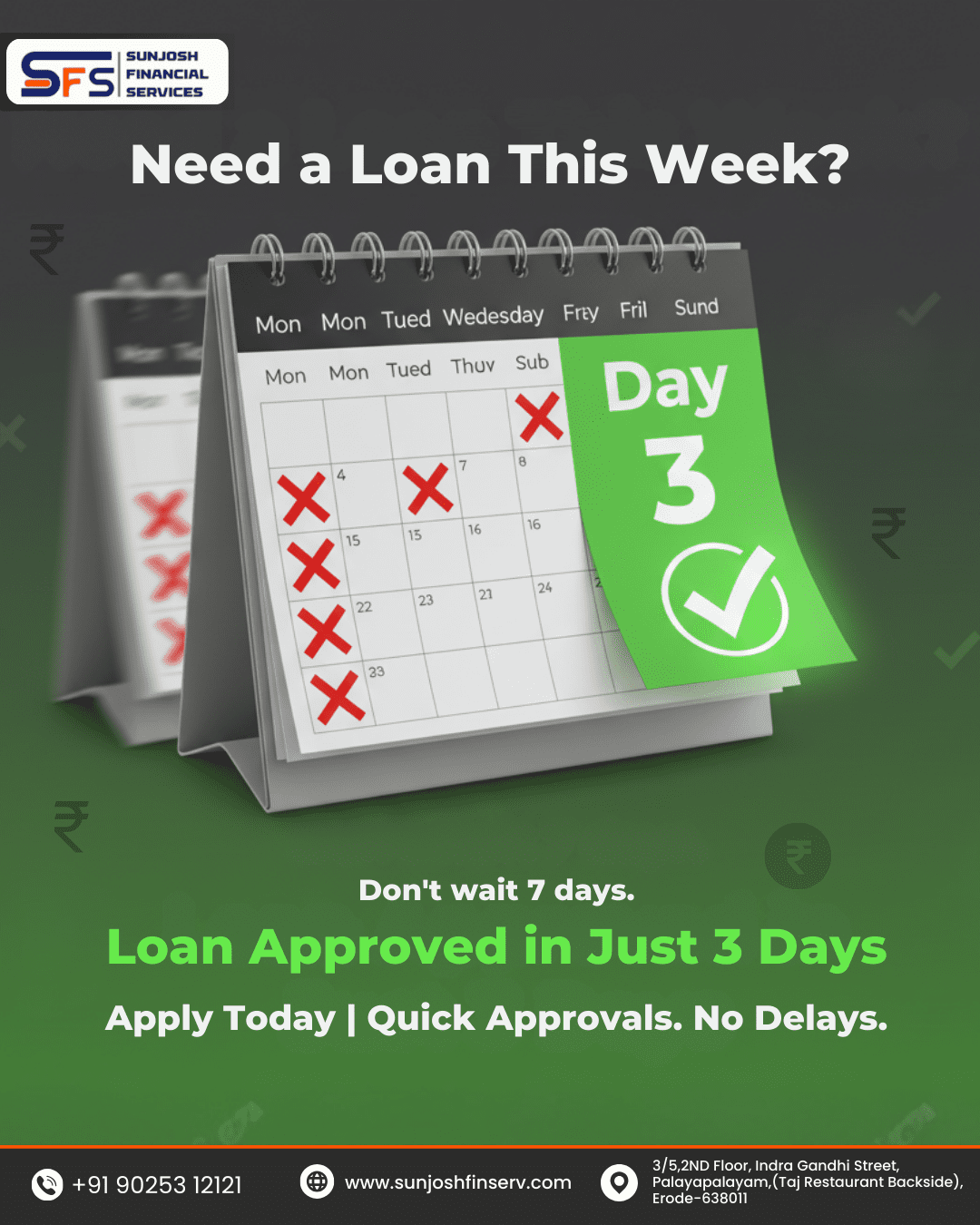

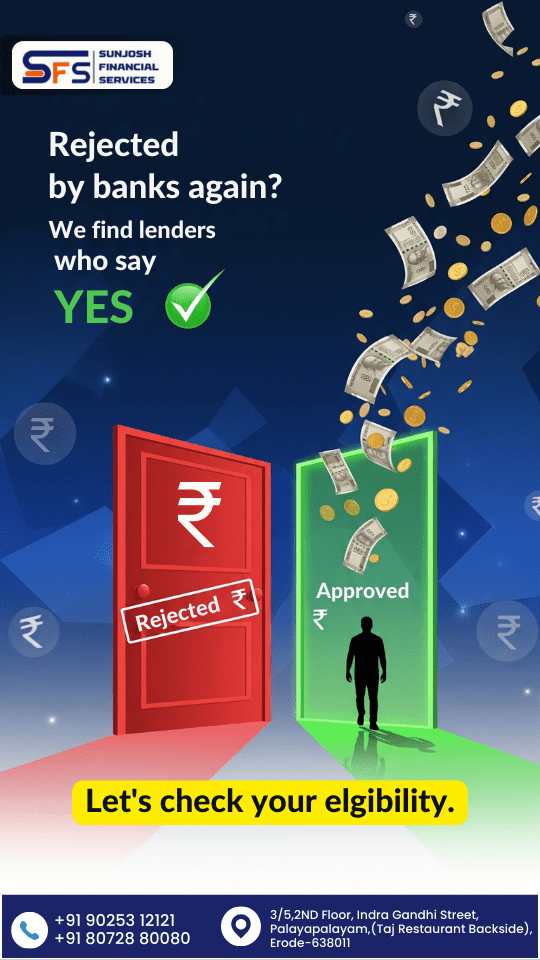

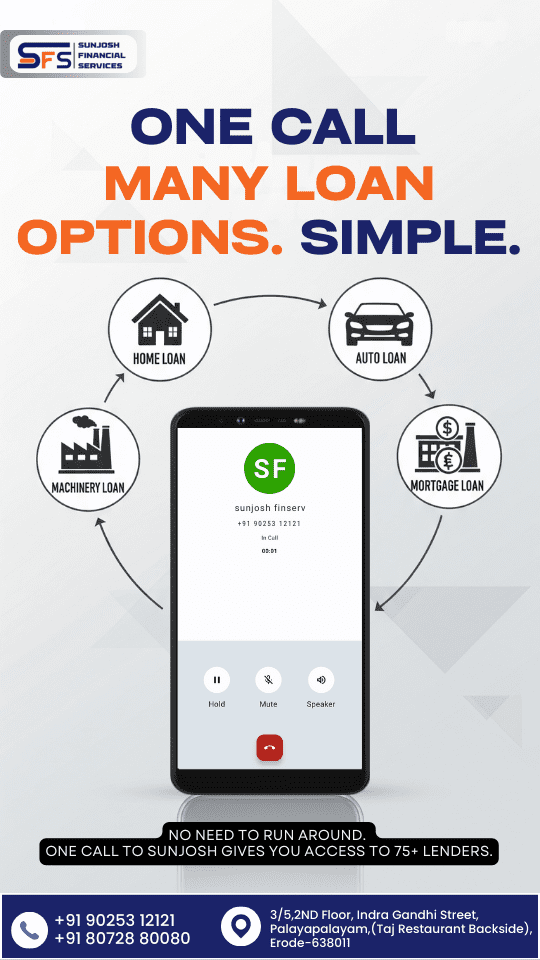

For Sunjosh Finserv, I created commercial ads focused on trust-building, clarity, and strong message recall—essential in a sector where customers hesitate due to fear of hidden charges, eligibility confusion, and loan rejection. Each ad was built to communicate the exact benefit within the first second, using bold headline structures and clean layouts to help viewers immediately understand what loan is offered, who can apply, and what advantage they get today.The ad set included personal loan creatives, business loan promotions, interest-rate benefits, top-up loan awareness, partner bank credibility highlights, and fast approval campaigns. Every creative was designed to turn financial jargon into simple decision-making messages that customers could easily act on.

- Personal loan offers

- Business loan promotions

- Top-up loan reminder ads

- Low-interest benefit ads

- Bank partner credibility ads

- Eligibility explanation ads

- Approval-speed ads

- Local audience trust ads

- WhatsApp enquiry booster ads

Each commercial creative followed a hook-first structure — a bold line that catches attention in less than a second. This was followed by a simple benefit message and a clear action note (“Check eligibility now”, “Call to apply”, “Send documents on WhatsApp”).

By keeping the design clean, removing unnecessary details, and highlighting only what helps decision-making, these ads successfully reduced the psychological barriers customers face in finance marketing.The result: faster enquiries, higher eligibility checks, and more walk-in conversations from genuinely interested customers.

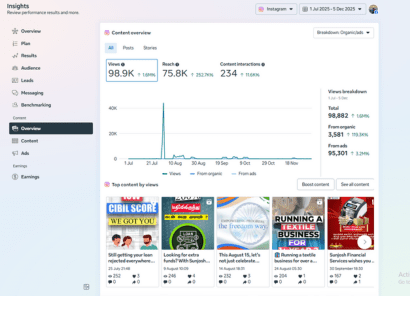

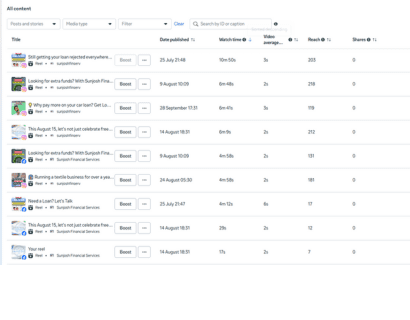

Analytics & Optimization

I tracked performance across Instagram and Facebook to understand what type of content worked best for them. Based on reach, interactions, story views, audience behaviour, and WhatsApp responses, I kept refining the creatives, hook points, and posting pattern to maintain high visibility and engagement.

Instagram Overall Performance

- Total Views: 98.9K

- Total Reach: 75.8K

- Content Interactions: 234

- Link Clicks: 197

Facebook Overall Performance

- Total Views: 117.6K

- 1-Minute Views: 3

- Content Interactions: 96

- Link Clicks: 38

Top Posts Performance

- Highest Reach Post: 28.9K+

- CIBIL Score Awareness Post – strong engagement

- Loan Rejection Solution Post – high viewer retention

- Textile Business Loan Reel – strong local reach

This performance data reflects the impact of a structured content strategy, clarity-focused messaging, and trust-building loan communication. From achieving over 98K Instagram views and strong Facebook visibility to generating consistent interactions and link clicks from loan-interested users, the analytics confirm that the approach effectively strengthened Sunjosh Finserv’s online credibility and enquiry potential. By simplifying financial information, improving recall through benefit-driven creatives, and maintaining regular visibility through posts, stories, and WhatsApp updates, the strategy increased user confidence, encouraged eligibility checks, and positioned Sunjosh Finserv as a trustworthy, customer-friendly financial support partner in the local market.

Content Calendar Planning

To maintain consistency and keep Sunjosh Finserv visible throughout the week, I created a structured monthly content calendar built around clarity, trust-building, and problem-solving communication. The plan balanced CIBIL education, loan eligibility awareness, offer-driven promotions, customer reassurance posts, and WhatsApp status updates — all aligned with audience behaviour insights.

Each week included a mix of reels, static posts, carousel explainers, and WhatsApp creatives to ensure message variety, higher recall, and repeated visibility among salary-based and business-based audiences. The calendar also helped maintain predictable posting rhythms, highlight peak engagement timings, and align promotional messaging with loan demand cycles (month beginning, salary dates, festival finance demand, etc.).

By planning content in advance, I ensured the brand stayed active every week without gaps, supported ongoing lead-generation campaigns, and responded quickly to new finance offers or policy changes. This structured approach strengthened Sunjosh Finserv’s visibility, audience trust, and enquiry flow across Instagram, Facebook, and WhatsApp.

- Instagram Posts: 3 posts per week ( carousels, offer creatives)

- Instagram Reels: 2 posts per week ( carousels, offer creatives)

- WhatsApp Status Post: Dialy Post with 4-line messages per Post

- Commerical Ads : Weekly 1 Reels Format Ads

Brand Positioning & Results Achieved

Through consistent clarity-driven messaging, simplified financial explanations, and trust-oriented creative design, Sunjosh Finserv developed a strong and dependable brand identity in the local market. The communication style shifted away from complicated banking language and instead became clear, reassuring, and customer-focused — positioning the business as a reliable and approachable financial support partner for both salaried professionals and small business owners.

This refined brand positioning directly reflected in the results. Customers began engaging more with CIBIL education posts, loan rejection solution content, and simple eligibility explainers, which reduced confusion and increased confidence. Content around personal loans, business loans, and approval benefits consistently drove link clicks, profile visits, and repeated enquiries from users seeking guidance.

Daily WhatsApp status updates strengthened recall, Instagram reels improved educational reach, and targeted posts increased clarity for first-time loan seekers. These continuous touchpoints helped address common customer doubts — leading to more meaningful enquiries and a noticeable improvement in the audience’s trust.

Overall, the combined strategy enhanced Sunjosh Finserv’s credibility, increased organic visibility across Instagram, Facebook, and WhatsApp, and positioned the brand as a knowledgeable, transparent, and customer-first financial service provider. This proved that a clarity-based, audience-aligned content approach can deliver measurable impact even without heavy advertising spend.